Voters Approve More Than Two-Thirds of Oregon’s Local Bond Measures

Turnout surpasses 20% in May Special Election

Voters across Oregon considered 49 ballot measures in this week’s special election that would create or extend taxes, levies, and bond sales for public projects. Of the measures, 34 were passing as of Thursday at 10 a.m. for an overall pass rate of 69.4%.

Voter turnout surpassed 20%, with about 600,000 ballots counted from the state’s more than 3 million registered voters. This marks a modest increase from the 16.2% turnout in May 2019, though slightly below 21.3% in 2023 and 25.5% in 2021.

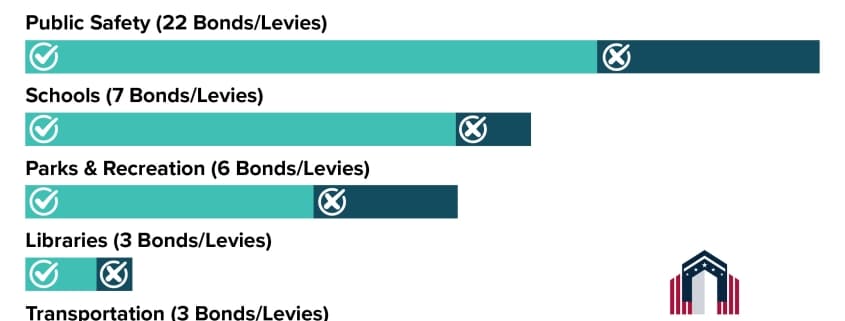

Voters showed overwhelming support for fire protection and education-related bonds, while police facility proposals struggled. Here’s how the major policy areas broke down, sorted by the number of total measures on the ballot.

🚨 Public Safety, Other (EMS/Mixed): 9 measures — 77.8% pass rate

🚓 Public Safety, Police: 8 measures — 50% pass rate

🏫 Schools: 7 measures — 85.7% pass rate

🏞️ Parks & Recreation: 6 measures — 66.7% pass rate

🧯 Public Safety, Fire & Rescue: 5 measures — 100% pass rate

📚 Libraries: 3 measures — 66.7% pass rate

🚗 Transportation: 3 measures — 66.7% pass rate

💧 Utilities: 1 measure — 0% pass rate

🧾 Other/Miscellaneous: 7 measures — 71.4% pass rate

Passed

- City of Albany: Renewal of the Ambulance, Fire, and Police Local Option Tax — 77.86% YES to 22.14% NO (margin: +55.7%)

- Santa Clara (Eugene) RFPD: Five Year Local Option Tax for General Operations — 76.9% YES to 23.1% NO (margin: +53.8%)

- Prospect Rural Fire Protection District: Five-Year Local Option Levy for general operations — 57.5% YES to 42.5% NO (margin: +14.9%)

- Molalla Fire District: Bonds for Public Safety — 56.6% YES to 43.4% NO (margin: +13.2%)

- East Lincoln County Fire & Rescue District: Five-year levy for equipment and disaster preparedness — 55.8% YES to 44.2% NO (margin: +10.6%)

- Lowell RFPD: Five-year operational levy — 52.1% YES to 47.9% NO (margin: +4.2%)

- Central Oregon Coast Fire & Rescue District: Renewal of 5-year Operational Levy — 54.8% YES to 45.2% NO (margin: +9.6%)

Failed

- Rocky Point Fire & EMS: Five-year levy for operations and maintenance — 48.4% YES to 51.6% NO (margin: –3.1%)

- East Klamath County Public Safety District: Formation of District, $89 tax/lot — 21.4% YES to 78.6% NO (margin: –57.2%)

Passed

- City Of Sweet Home: Police Five-Year Operating Levy Renewal — 67.1% YES to 32.9% NO (margin: +34.2%)

- Columbia County: Renewal of Tax Levy for Jail Operations — 63.9% YES to 36.1% NO (margin: +27.9%)

- City of King City: Police and Public Safety Local Option Levy — 62.7% YES to 37.3% NO (margin: +25.5%)

- City of North Bend: Public Safety Fee Increase — 53.2% YES to 46.8% NO (margin: +6.4%)

Failed

- City of Forest Grove: Bonds to Replace Police Facility — 48.8% YES to 51.2% NO (margin: –2.3%)

- City of Dallas: Police Facility Bonds — 45.1% YES to 54.9% NO (margin: –9.8%)

- City of Umatilla: Bonds for New Police Station — 41.9% YES to 58.1% NO (margin: –16.2%)

- Curry County: Law Enforcement Levy — 39.8% YES to 60.2% NO (margin: –20.4%)

Passed

- Dufur Recreation District: Three-Year Operations Levy — 80.8% YES to 19.2% NO (margin: +61.6%)

- Midland Community Park: Formation of New Park District — 57.6% YES to 42.4% NO (margin: +15.2%)

- City of Salem: Five-Year Operating Levy for Parks, Recreation, Libraries, and Senior Services — 55.68% YES to 44.32% NO (margin: +11.36%)

Failed

- City of North Bend: Parks, Recreation, and Pool Fee — 28.8% YES to 71.2% NO (margin: –42.4%)

- City of North Bend: Dog Park Fee — 20.6% YES to 79.4% NO (margin: –58.8%)

- Madras Aquatic Center and Recreation District: Formation of New District — 47.9% YES to 52.1% NO (margin: –4.2%)

Passed

- Lincoln County School District: Bonds for safety, repairs, and vocational education — 67.77% YES to 32.23% NO (margin: +35.5%)

- Portland Public School District 1J: Bonds to modernize, repair schools, improve safety — 57.64% YES to 42.36% NO (margin: +15.3%)

- Sheridan School District 48J: Bonds for safety/security and capital improvements — 51.88% YES to 48.12% NO (margin: +3.8%)

- Chemeketa Community College: Bonds to upgrade CTE, technology, facilities, and safety — 51.63% YES to 48.37% NO (margin: +3.3%)

- Tigard-Tualatin School District 23J: Bonds to modernize schools and improve safety — 50.34% YES to 49.66% NO (margin: +0.7%)

- Morrow County School District No. 1: Bonds to remodel, replace schools; improve safety; address structural deficiency — 50.3% YES to 49.7% NO (+0.6%)

Failed

- Mt. Hood Community College: Bonds for career education, safety/security, and facility repairs — 48.68% YES to 51.32% NO (margin: –2.6%)

Passed

- Jackson County Rural Fire Protection District 4: Five-year local option tax — 60.0% YES to 40.0% NO (margin: +20.0%)

- Lake Chinook Fire & Rescue: Five-year operations levy — 59.4% YES to 40.6% NO (margin: +18.8%)

- Hoodland Fire: Bonds for new fire station — 58% YES to 42% NO (margin: +16.0%)

- Aumsville Rural Fire Protection District: EMS operations levy — 53.7% YES to 46.3% NO (margin: +7.4%)

- Hubbard Rural Fire Protection District: Fire & EMS Levy — 52.0% YES to 48.0% NO (margin: +3.9%)

Failed

None

Passed

- City Of Sweet Home: Library Services Levy Renewal — 68% YES to 32% NO (margin: +36%)

- City of Stayton: Five-Year Library Support Levy — 56.7% YES to 43.3% NO (margin: +13.4%)

Failed

- Jefferson County Library District: Library Bond for Facilities — 47.23% YES to 52.77% NO (margin: –5.5%)

Passed

- City of Milton-Freewater: Transit Levy Renewal — 61.1% YES to 38.9% NO (margin: +22.2%)

- Two Rivers North Road District: Five-Year Local Option Tax — 60.5% YES to 39.5% NO (margin: +20.9%)

Failed

- City of Hubbard: Local Fuel Tax — 46.2% YES to 53.8% NO (margin: –7.5%)

Failed

- North Bend City: Sewer Rate Increase — 42.4% YES to 57.6% NO (margin: –15.2%)

Passed

- Pine Eagle Health District: Local Option Tax — 78.1% YES to 21.9% NO (margin: +56.1%)

- Black Butte Ranch Service District: Five-Year Local Option Levy — 68.4% YES to 31.6% NO (margin: +36.7%)

- Clatsop County: Fairgrounds Levy Renewal — 67.7% YES to 32.3% NO (margin: +35.4%)

- White River Health District: Tax Levy Renewal for Health Clinic — 63.8% YES to 36.2% NO (margin: +27.6%)

- Cascade View Estates Tract 2 Special Road District: Road Resurfacing Levy — 56.8% YES to 43.2% NO (margin: +13.6%)

Failed

- Tillamook County: Lodging Tax Increase (10% → 14%) — 49.9% YES to 50.1% NO (margin: –0.3%)

- Polk County: Fairgrounds & Events Center Tax — 40.6% YES to 59.4% NO (margin: –18.8%)

While most outcomes are clear, several measures passed or failed by narrow margins and may shift as final ballots are counted and certified over the coming month, with final certification required by July 7.

At a time when inflation and cost of living remain top concerns, the results of this election reflect a notable trend: Oregonians are still willing to invest in community-level services — especially those tied to safety, education, and quality of life.

ChatGPT OpenAI was used to collect and calculate the data used in this report, and the Pac/West team reviewed and verified the finals results.