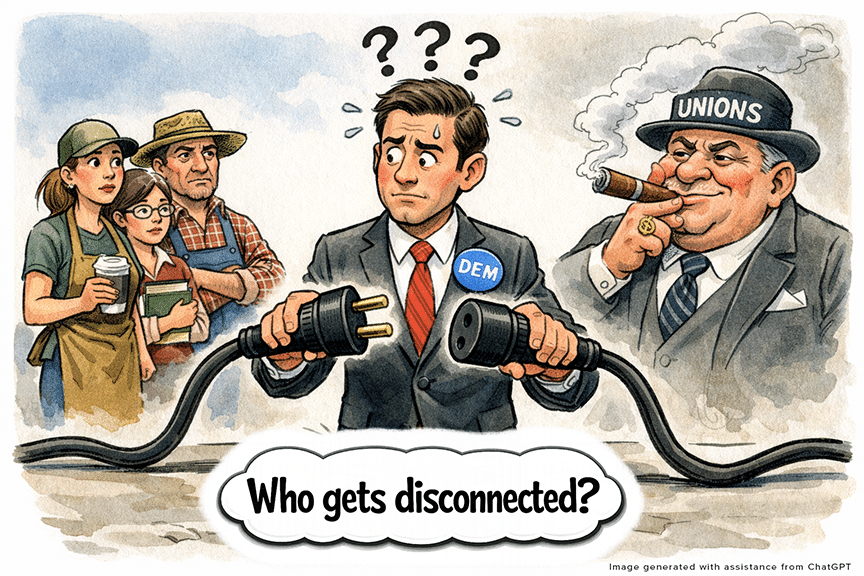

Discontent Over the Disconnect

Separating Oregon tax code from federal legislation could backfire

When it comes to politics, there is often a disconnect. One person’s solution is another person’s headache.

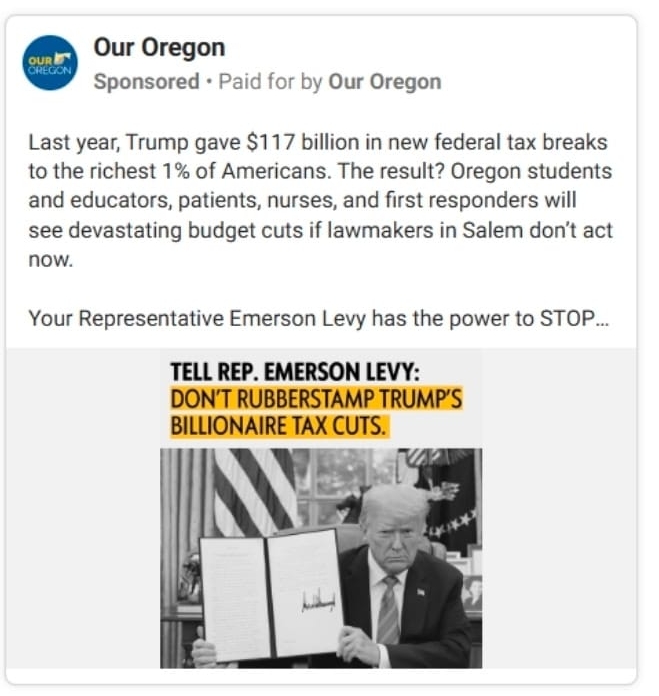

Public employee unions, the source of mother’s milk for Democratic campaigns, have been funding attack ads (or ‘educational messages’) on television and social media screens in some Democratic districts, hoping to pressure those members to vote to disconnect Oregon’s tax code from recently passed federal legislation.

Known as the ‘One Big Beautiful Bill’ by some, and the ‘Obscene Billionaire Bailout Bill’ by others, the legislation has a significant negative impact on Oregon’s state budget. Public employee unions are among those demanding legislators disconnect from the tax provisions of the federal legislation when it comes to assessing state income taxes on Oregonians. Doing so will help decrease the deficit now facing legislators as they try and save key programs and services from further reductions.

The ad strategy, however, is ill-advised and likely to backfire. Legislators may disconnect all right, just not the way some advocates had planned.

The ad strategy, however, is ill-advised and likely to backfire. Legislators may disconnect all right, just not the way some advocates had planned.

Those attacked will either recall why they were born with a middle finger or simply climb off the fence to the other side so as not to be labeled as bought and owned by political donors.

Political funders helped push Democrats into the quicksand on the transportation bill. Some of those legislators are not likely to be shoved into it again, hoping for a different result.

That leaves Democratic leaders stuck between the proverbial rock and a hard place, and Republicans showing no signs of grabbing a crowbar to pry them loose.

Voters’ Wallets Drive the Debate

Yes, there are significant giveaways for the billionaire class. But Oregon only has three of them (billionaires, that is) and together they have given hundreds of millions away to various charities, so it is not a motivating message. Voters are more concerned about their own bank balance than worried about the checkbook of someone else. Yesterday, the Conference Board announced that consumer confidence dropped to its lowest level in 12 years as consumers fret over their income, expenses and the economy.

So, what are the tax breaks costing Oregon hundreds of millions of dollars in revenue the legislature might consider peeling back? How about taking back the tax exemption for tips earned by struggling restaurant servers or clawing back the tax exemption for overtime pay by farm workers? Roll back the expanded tax credit for a working mother’s childcare or how about the additional tax credits for seniors living on social security? What voter could possibly be upset about losing those?

Are Democratic leaders, already stung by the self-inflicted implosion of their transportation tax plan, prepared to play chess this time or unwittingly face checkmate by Republicans who are already plotting two moves ahead.

What if Republicans demand any disconnect bill be referred to the voters? Would Democrats vote that amendment down and press ahead anyway only to be buried in press coverage like: “Democrats have learned nothing from their transportation tax bill and are once again refusing to let voters decide on issues impacting their own family budgets.”

Where is the proposal? Like the transportation bill of 2025, will this bill be sprung with little time for the public (and legislators) to evaluate or amend? This is a sharp two-edged sword. If they reserve for plenty of public input in both chambers for the short five-week session, will they even have time to pass it? Will Republicans just walk out in each chamber a few days throughout the process and run out the clock on the session?

Who is the Democratic chess master for the session strategy?

Federal Cuts Require Federal Solution

The biggest hit, and it’s a huge one, to the state’s budget is not the tax cuts (most are temporary anyway), but in spending decisions by Congress forcing reductions in funding to states for food stamps for low-income families and in cuts to Medicaid and the Affordable Care Act, which risks the loss of health care coverage for tens of thousands of Oregonians.

These are real and devastating. A change in Congress, however, is the only likely solution to solving those issues and Democrats are hard at work. Democrats are winning nationally on that front according to almost every recent poll. But again, it is because the issue of affordability resonates.

On the things Oregon can change, there may be elements of the tax code where the state can disconnect without impacting some of the more popular provisions. The analysis then must be: Are those savings enough to make a meaningful difference in budget reconciliation when weighed against a messaging war on affordability that to date, local Republicans appear to be winning.

One thing is clear: Attacking your own troops is not a way to win that battle.