Of Scarecrows, Theorems & Oregon’s Isoscelese Triangle

It has been over four decades since I last crossed paths with the Pythagorean Theorem. We have not missed each other. Save for the chemists, scientists, surveyors, and engineers, most of us have managed to muddle through life reasonably well despite the concerns of our algebra teachers.

Students today face a more complex world, especially in navigating the tar pits of personal finance, asset management, and risk aversion. Oregon has not required a semester of personal finance in a quarter of a century in public high schools. Almost immediately after it was subtracted from graduation requirements, educators, parents, and students began trying to add it back in.

Financial literacy has been in a decades-long courtship with the Oregon Legislature, only to see the nuptials continuously disrupted on the altar by Sine Die. This session, fueled by legislative leadership, teachers, school board members, and committed advocates, we may finally witness the tying of the knot.

The Senate Committee on Education is scheduled to have a work session Thursday on Senate Bill 3 that, when amended in committee, will guarantee a robust semester of personal financial empowerment curriculum for Oregon students.

Oregon may be late in recognizing how critical these tools are for graduates to have in their life planning arsenal, but they are being joined by at least nine other states this year rushing to make up for lost time in their educational offerings. More states passed legislation last year, including Michigan. The Michigan Education Association, administrators, parents, and business leaders led a half-credit personal finance requirement to the governor’s desk with votes of 35-2 in the Senate and 94-13 in the House.

So, what has changed in Oregon? Some of the 17- and 18-year-olds discussed on the floor of the legislature more than two decades ago are now sitting in those legislators’ chairs. Back then, lawmakers and advocates made an emotional case to arm students with financial empowerment tools to minimize the chances that they might end up in a spiral of homelessness and be unable to afford vital services. Twenty years later, some of these young legislators have lived that prophecy through their friends, family, and classmates.

In a quickly evolving and complex financial world, they have witnessed first-hand the social and economic impacts of misguided financial decision-making. While the Legislature rolls out hundreds of millions of dollars to battle the backend consequences of housing shortages, homelessness, mental illness, and other issues, restoring financial literacy in school can help eliminate a subset of those individuals from the next generation of adults.

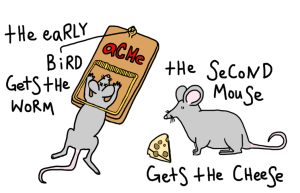

Studies demonstrate that part of the homeless population can be associated with poor financial decision-making, planning, and understanding of the perils of living on debt. It is not just the poor that comprise this population. A recent study found that 50.8% of people making over $100,000 a year live paycheck to paycheck. Those making up to $200K annually are not much better off at 47%.

Bills Add Up to Solve Issue in 2023

SB 3 provides future planning essentials to students, including resume writing, interview techniques, filling out college admission and financial aid forms, and other career option opportunities and guidance. It is a half-credit course. The final bill will amend portions of HB 3094 to direct a separate half credit of financial literacy and allow the Department of Education to have that credit satisfy the state’s current math requirements.

Some schools took things into their own hands. Newport High School is one example, where algebra teacher Isaac Bass teaches a robust personal finance curriculum. It is so popular with students that the classes are often oversubscribed. Read some of the students’ letters to the committee.

Bass and fellow personal finance teachers incorporate algebraic principles wherever possible to demonstrate how students can build their financial futures. An example is using basic algebra to calculate the total cost of a home mortgage from the interest accrual in the amortization tables of options like 30-year fixed, 15-year fixed, and five-year variable mortgages while using different interest rates and down payments. The class also counts towards the student’s state-required math requirement.

Now the Oregon Legislature is on the verge of guaranteeing every student access to the tools they need to succeed in real life. It is time to solve the equation.

If a scarecrow can do the math-then so can we!