The Tax Man Cometh

Back in my days as a television sports reporter, I worked with a cameraman named Gary Beck. We called him “The Tax Man” because if it was there, he always captured it. The City of Salem is poised to take over Beck’s crown with a new payroll tax that will capture it all.

The City Council voted this week to impose a payroll tax on all employees and independent contractors “for work performed within the Salem city limits.” The ordinance particularly calls out employees of the “State of Oregon” and “any political subdivision of the state.”

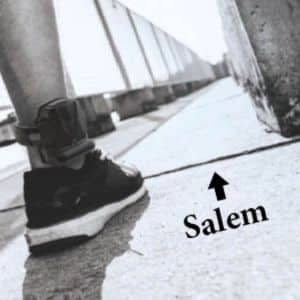

This should be a big boon for ankle bracelet monitoring companies. Step into the Salem city limits, and the meter starts to run. Imagine the Cherriots bus driver making his route, picking up passengers in Salem, then exiting the city limits for the rest of the route. The plain language of the ordinance suggests that the wages earned on the route within the city would be taxed, and the bus stops made outside the city limits would not. Or the Marion County sheriff deputy who works a shift in Keizer has to appear for testimony at the Marion County Courthouse in Salem. Those hours would be taxed; the others would not.

As written, the ordinance also discriminates against company employees over independent contractors. The ordinance says the tax is to be imposed on an employee’s wages. That’s the box on your W-2 before deductions for federal and state taxes, social security, Medicare taxes, health insurance deductions, and retirement contributions. But if you are an independent contract performing the same work, you pay only on “net earnings.” Let’s say you make gross wages of $100,000 and take home about $67,000. Your deductions would come from the full $100,000, but the same calculation for the self-employed would only be on the $67,000. What could be wrong with that?

The ordinance is purported to be designated only for “community safety services” but doesn’t tax city residents for those services. A resident in Salem enjoying those services but is retired or works a few miles away in Keizer won’t pay the tax. But a Keizer resident paying Keizer city taxes for services will also pay the Salem services if they work in Salem.

It should also be a big boost for remote work and investors in Zoom Communications. Perhaps Marion County would want to move county offices from downtown Salem and move over to Keizer. It could also be an economic boon for the City of Keizer, although Keizer Mayor Cathy Clark told me she “doesn’t want to comment at this time.”

Citizens testifying before the city council overwhelmingly asked that councilors refer the ordinance to the voters. According to a story in The Oregonian, Councilor Virginia Stapleton said she and other councilors “don’t have the time or resources to lead a campaign to convince voters to approve the tax.”

Should citizens wish to refer the payroll tax to voters, they face a difficult challenge. Unlike citizens who refer to state legislative actions who have 90 days to acquire signatures equal to 4% of voters who voted in the last gubernatorial election, Salem gives only 30 days and requires 10% of voters who voted in the last mayoral election. In reality, it is not even that much. The city says it has to prepare a ballot title and validate signature procedures before signatures can be gathered, and the city counts the time for that against the 30 days.

Clearly, the city is trying to find a way to balance the budget and continue a vital city function. It is important. But equity should demand a system that is less discriminatory, less bureaucratic, and less convoluted than the ordinance as written and passed.

A tax of this magnitude should involve a dialogue with the citizens of Salem and, ultimately, a vote of the people.