May Revenue Forecast Turns Attention to State Budget

Forecasters remove mild recession from model as budget writers get to work

The May Economic & Revenue Forecast released this week presents a favorable picture of expected revenue and economic conditions for Oregon in the next biennium as lawmakers get ready to write the state budget.

The improved picture includes $1.9 billion of new expected resources available since the previous forecast, released in February. The potential mild recession cited in that report is no longer part of the model.

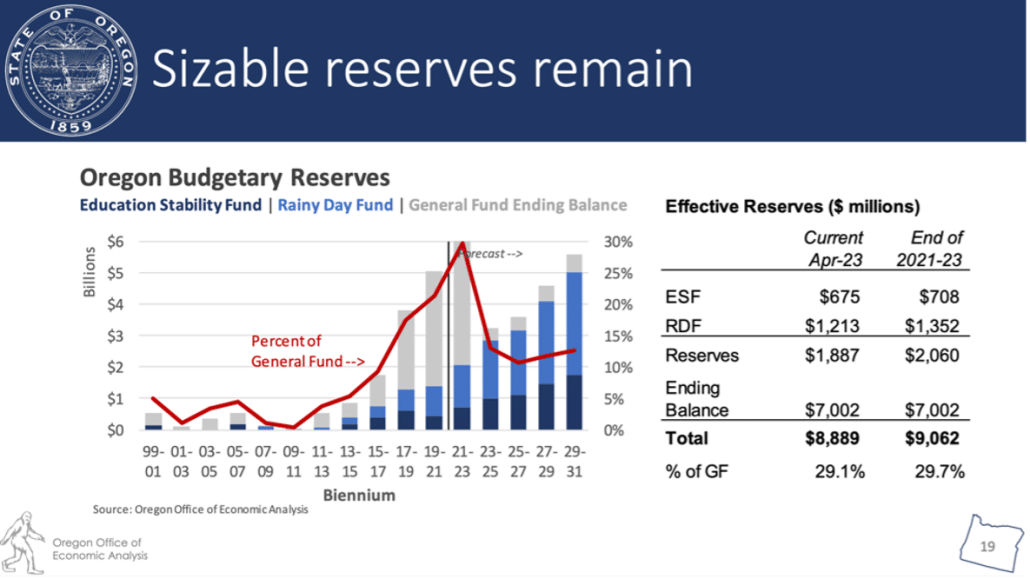

While factors leading to potential mild recession are still there, the major threats seem to have been neutralized and the effects are forecasted to be pushed out beyond the 2023-25 budget cycle. However, economic downturns are difficult to predict and so the Governor’s Recommended Budget calls for leaving state reserves untouched in case they are needed down the line. At the end of the 2021-23 biennium (June 30, 2023) current reserves will be:

- Education Stability Fund (ESF) = $708 million

- Rainy Day Fund (RDF) = $1.35 billion

- Ending Fund Balance = $7 billion

A historic personal tax kicker of $5.5 billion and corporate tax kicker of $1.8 billion have headlined most news coverage of the forecast. The kicker is based on the Oregon Office of Economic Analysis’ forecasts made more than two years in advance. When the office forecast is off by more than 2%, all of the revenue above the forecast, including the 2%, are credited back to taxpayers. The personal kicker will go back to taxpayers and the corporate kicker will feed into the Education Stabilization Fund (ESF).

Both the ESF and Rainy Day Fund (RDF) are expected to reach their caps in the 2025-26 fiscal year. When the ESF reaches its cap, any additional funding will go to a capital matching fund for schools. Anything additional in the RDF will go back into the general fund.

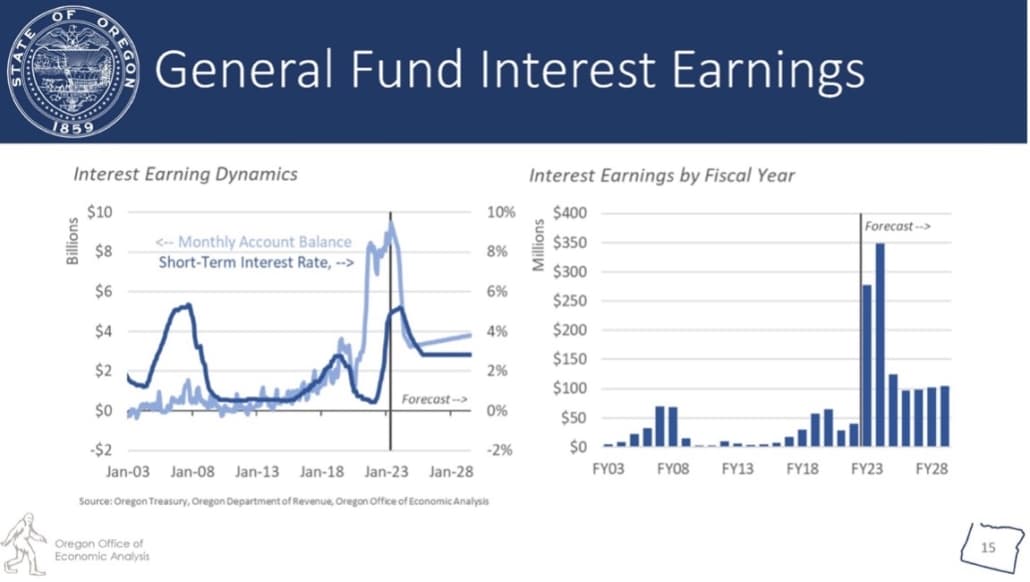

The ESF, RDF, and ending fund balance has allowed the state to squirrel away a record-high $9 billion in savings, which creates about $300 million in interest returns available for the general fund.

Legislators can now begin moving the larger budget items like Oregon Health Authority, Department of Human Services, and Department of Education through the Joint Ways & Means Committee. These will be followed by policy bills that will have a fiscal impact, and finally capital construction projects in the final weeks of the session. Committees will move quickly with just over a month left until Sine Die.

Unlike recent biennial budget processes, Gov. Tina Kotek’s proposed budget and the co-chairs budgets have been largely in alignment. This can be attributed to Kotek’s recent experience in the legislature and coordination with leadership on funding and agency priorities.

On Thursday, Senate Republican Leader Tim Knopp (R-Bend) said in a press release that Republicans would return to the Senate before Sine Die to finish the legislative process on the budget and other bipartisan bills.

However, if the standoff were to continue through the end of session, there is still a path to passing a budget after the end of the biennium on June 30. Each session, the legislature passes a standard continuing resolution (HB 5046-A). According to the staff measure summary, any state agency without an adopted budget for the 2023-25 biennium as of July 1, 2023 needs legislative approval to continue activities at a stated level. This continuing resolution provides expenditure authority for state agencies without budgets adopted for the 2023-25 biennium by July 1. The measure allows these agencies to continue operations at the same level as the last quarter of the 2021-23 biennium, with exceptions for the Oregon Health Authority and the Department of Human Services. Expenditure authority provided by this continuing resolution is authorized through September 15. The amount that an agency is authorized to spend under the continuing resolution counts toward the agency’s total 2023-25 budget.

The exact amounts are authorized by the Department of Administrative Services by administrative rule. The amounts can be adjusted to reflect actions in pending legislation. Pending legislation refers to a bill that has, at a minimum, passed out of a budget subcommittee or budget committee. This continuing resolution does not bind the Legislative Assembly in determining 2023-25 budgets while the continuing resolution is in effect.

Generally, the resolution gives the governor time to officially sign the budget on July 1 or later without disrupting state operations. But it could also give the opportunity to call a special session after July 1 with the sole purpose of approving a budget if the regular session is adjourned before a budget is approved.